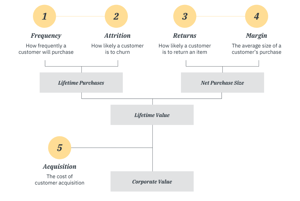

Appraise by Gradient:

Predictive customer analytics and corporate valuation

Your cohort analysis due diligence is not as accurate as it could be

Companies tend to have the least amount of information on their most recent and relevant customers. Appraise deconstructs customer cohorts to better understand business health and go-forward prospects.

Using historical cohort behaviors to project future spend will frequently lead to over-(or under-) estimates of future performance.

Optimize your marketing strategies by targeting potential customers with

similar profiles to those with the highest LTV.

Make better operational and investment decisions with highly predictive forecasts that provide clarity on both LTV distribution and company growth prospects.

The Gradient difference

- Define strategic objectives

Each Appraise project starts by identifying the specific investment decisions and strategic questions you need to address, ensuring analytics deliver actionable insights aligned with your goals. - Design targeted research

Utilizing advanced, proprietary modeling techniques on transactional data, Appraise precisely quantifies customer-related risk and opportunity for rigorous due diligence. - Analyze & interpret

Our team of data scientists and PhD researchers translate complex customer transactional patterns into clear, strategic insights, directly informing your investment decisions and growth strategies. - Activate insights

Instead of general reports, we deliver precise recommendations, enabling immediate strategic actions to enhance portfolio value and mitigate investment risks.

What you get

You will get a complete picture of the historic customer base of the company you're looking to acquire or sell.

- Customer Lifetime Value: Undiscounted 5-year Total LTV (including captured sales) net of returns

- Transactions: The total number of transactions expected per customer (including captured) over 5 years

- AOV: The average order value

- % Churned: The average probability that a given customer in the associated cohort has churned from the customer base

- ...And more.

Accurate estimates of what truly drives high customer value so you can target look-a-like audiences

- Drivers, such as acquisition channel, demographics, product purchases, and support interactions can be modeled in a way to identify drivers of customer profitability

- Discover how acquisition channels drive LTV over time, and reconsider your ad spend strategies accordingly (see example graph)

- Learn how first purchase basket size influences LTV over time

- Identify which initial product purchases are most likely to have a high LTV, and incentive customers to add those products to their initial purchases

Appraise deconstructs customer cohorts to better understand business health and go-forward prospects.

- Using historical cohort behaviors to project future spend will frequently lead to over-(or under-) estimates of future performance

- In this example, the Appraise model suggested a meaningfully different future for the business vs. traditional cohort models; this example business is currently tracking slightly below, but inline with the Appraise estimate

- A detailed breakdown of projected revenue by various CPA and ad spend scenarios

Success stories at a glance

Trusted by leading organizations